FINANCE SPY/ Worrying "coded messages" from Japan

It is necessary to carefully look at what happened this week in the auctions of 10- and 30-year Japanese government bonds

How did the two Japanese government bond auctions this week go? If the Machiavellian logic we're referring to is that of achieving results at all costs, of the cursed few and immediately , then mission accomplished.

In reality, it feels like an hourglass with ever-decreasing sand. And about to descend at an ever-increasing rate. In short, be careful not to give up on the August battle.

Let's start with yesterday's auction of the 30-year bond. First, let's put the whole issue into perspective. Before offering its debt to the market, the Bank of Japan had intervened 13 times in the last six trading days to provide dollar collateral to the country's banks. In other words, the usual round-trip transaction, the backdoor funding that the Bank of England has also been operating in the same way for quarters with its Thursday Short-Term Repo facility. A resounding success, then?

Not much. Starting with demand, which dropped to 3.43% from 3.58% at the previous auction, held just July 2nd. In short, despite the more than attractive yield and, indeed, a week of cascading financing from the Central Bank, enthusiasm has cooled. And not a little. And the yield, exactly? 3.089% versus 2.808% on July 2nd. Above the Maginot Line of 3%. A psychological barrier for the 30-year bond. And indeed, demand has suffered.

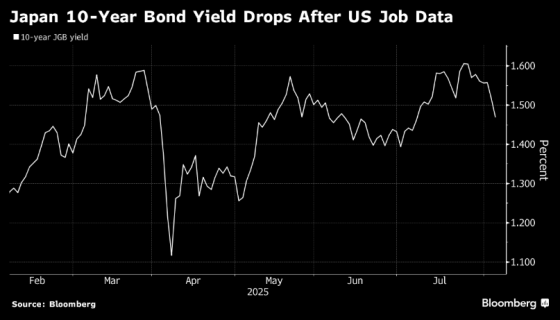

And the 10-year bond auction held on Tuesday? All the money was placed. But with a yield of 1.462% versus 1.442% on June 30th. Up. Admittedly, in this case, a long way from the 1.512% of June 2nd. And still below the psychological threshold of 1.5%, a dream come true for those investing in benchmark Japanese paper.

Is this the whole point of the watershed event I've been boring you with for at least two weeks? Just a bipolar logic of the glass half-full and the glass half-empty? No. Let's take the 10-year bond price. Unlike the 30-year bond price, which only seems to suggest a dangerous encroachment into the risk-off zone, it already betrays the signs of aggressive treatment. A 3.06 bid-to-cover ratio versus the 3.51 of the previous offering and the 3.17 12-month average should give pause for thought. Not because of the number itself. But because of the conditions under which the auction was held. Perfect manipulation by the Bank of Japan, as explained above. But increasingly desperate.

And the fact that it was Bloomberg, and not a notorious conspiracy theorist like myself, who highlighted, with a graphic, the fact that the US employment data pushed the yield on the 10-year Japanese bond below the psychological threshold of 1.5% just before Tuesday's auction, gives pause. Or at least it should.

If only for the caravan that non-farm payrolls number has generated, even with Donald Trump's dismissal of the head of the Bureau of Labor Statistics. Do you think it will happen very often again that a highly ritualized data on jobs will transform into a market mover at this political-media level?

On the other hand, take a look at this other chart: it shows us how that very US employment figure performed a double miracle, both domestically and for its ally Japan. As of today, the Fed is expected to cut rates in mid-September at 95%.

And voilà, the Japanese yield before the two auctions incorporated, in addition to the BOJ collateral, the US futures pivot . In the case of the 10-year bond, this ensured that immediately before the auction, the yield fell below the 1.5% Maginot rate. But not for the 30-year bond. It remained above 3%, both before and immediately after the placement. This is a sign that the market is aware of the ticking time bomb effect that long-term debt is already having on the balance sheets of Japanese banks and insurance companies.

And indeed, in keeping with the rites of that now delirious fantasy world that some still insist on calling the market, the day before the 10-year auction, Japanese bank stocks literally plummeted to a 16-month low. All of them . The reason? The CEO of Norinchukin, the cooperative bank of fishermen and farmers, suggested in an interview with the Financial Times a more cautious approach to future investments, after admitting $12 billion in losses on holdings of U.S. Treasuries.

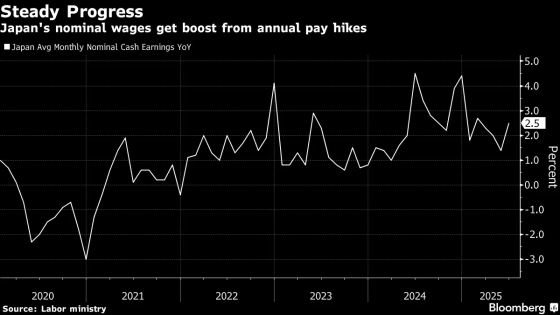

But that's not all. Because, concurrent with the 10-year bond auction, the minutes of last week's Bank of Japan meeting were released on Tuesday morning. This was precisely the meeting that kept rates unchanged, while raising its inflation forecast for this year from 2.2% to 2.7%. And given this trend in nominal wages, which accelerated sharply in June, it's clearly destined to impact price dynamics (or does the risk of the mythical spiral only exist when it's convenient?).

And what has emerged? That price dynamics would dictate an unmanageable rate hike. But only after tensions over duties and tariffs have calmed. Coincidentally, Donald Trump yesterday decided to increase tariffs on Japanese exports by another 15%, despite the much-vaunted trade agreement with Tokyo. As it turns out, if chaos is needed to postpone a rate hike that neither the yen nor the Nikkei can sustain, our American friend will come to the rescue with the threat of a macroeconomic earthquake. After all, as we all know, everything will eventually be postponed. Or even reneged.

The perfect manipulation . But so complex and desperate in its now brazen ways that it confirms the therapeutic obstinacy. For Japan, it's not a question of if . But only of when .

— — — —

We need your help to continue providing you with quality, independent information.

İl sussidiario